tax forgiveness credit pa

To claim this credit it is. To receive tax forgiveness a.

13589 Pa Municipality Tax Return Out Of State Credit For School Tax

What is a Pennsylvania tax forgiveness credit.

. Ad Trusted Tax Company. Ad Owe IRS 10K-250K Back Taxes Estimate Tax Debt Online to Check Eligibility. Tips for Tax Forgiveness.

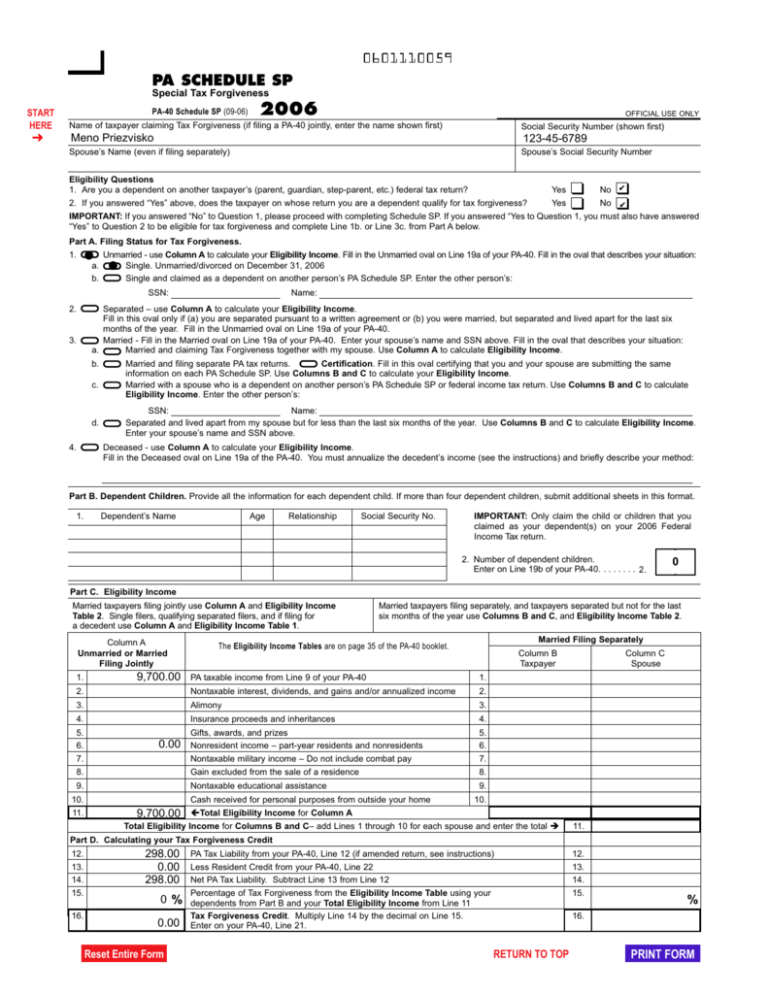

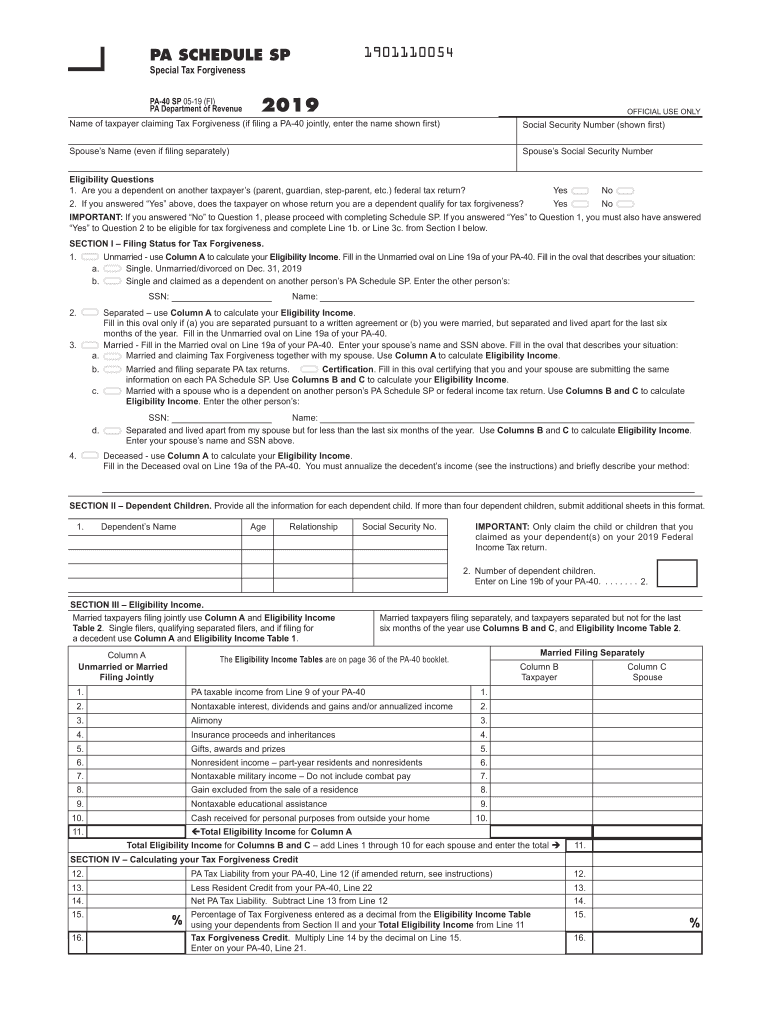

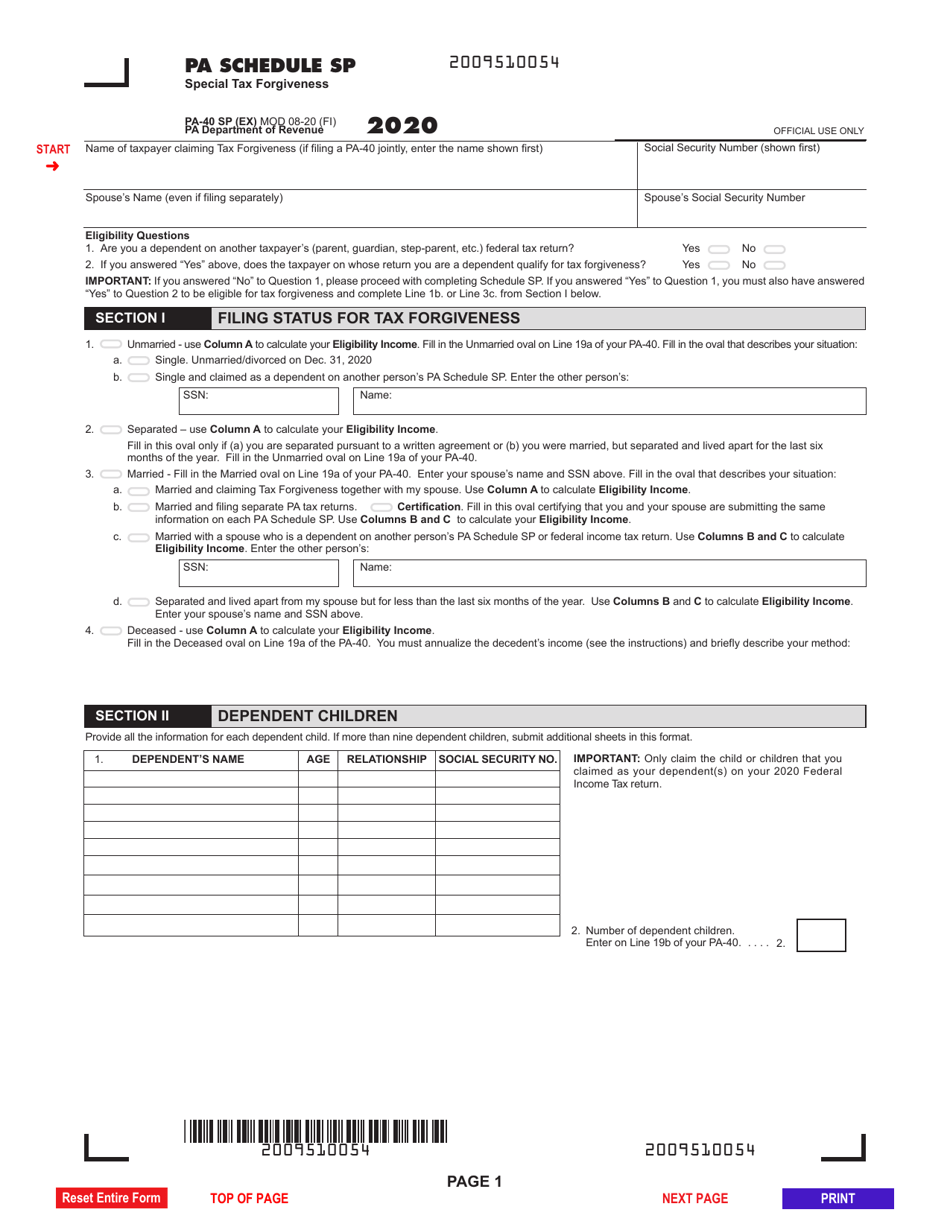

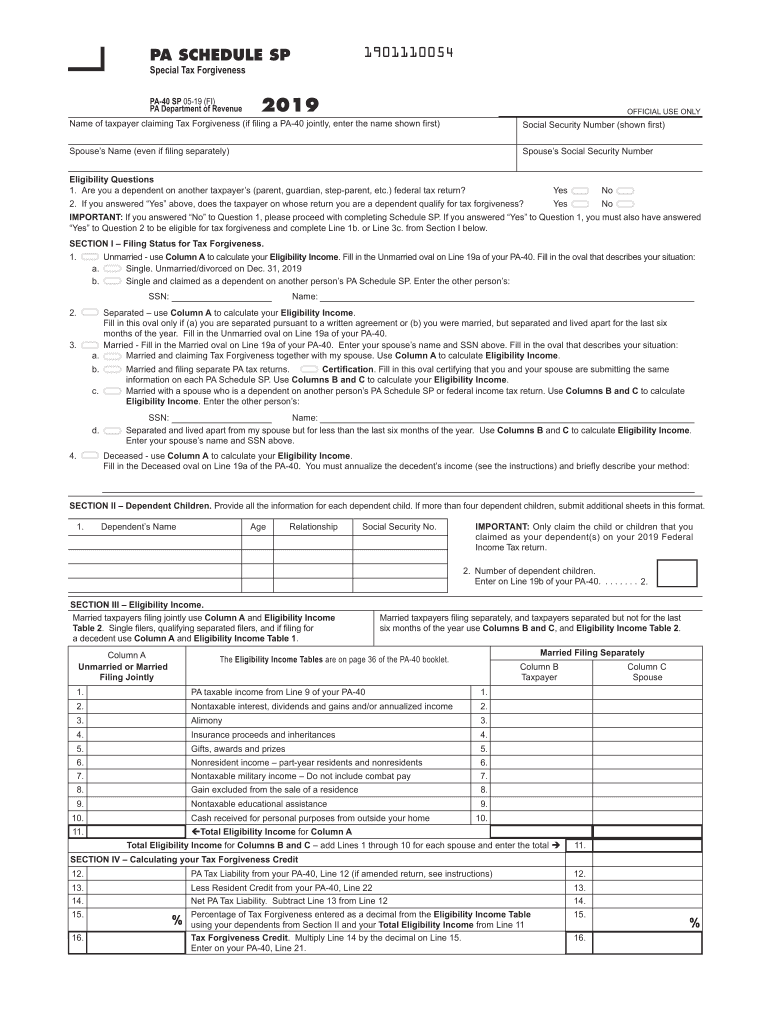

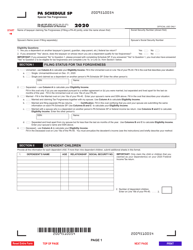

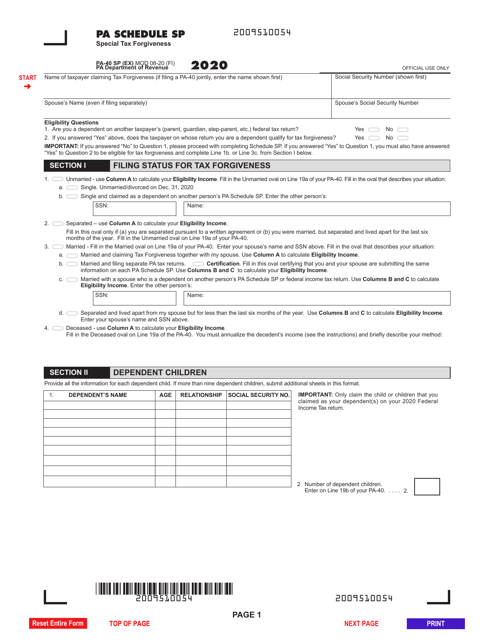

However any alimony received will be used to calculate your PA Tax Forgiveness credit Schedule SP. Tax forgiveness is a credit that allows eligible taxpayers to reduce all or part of their Pennsylvania personal income tax liability. Tax Forgiveness is a credit against PA tax that allows eligible taxpayers to reduce all or part of their PA tax liability.

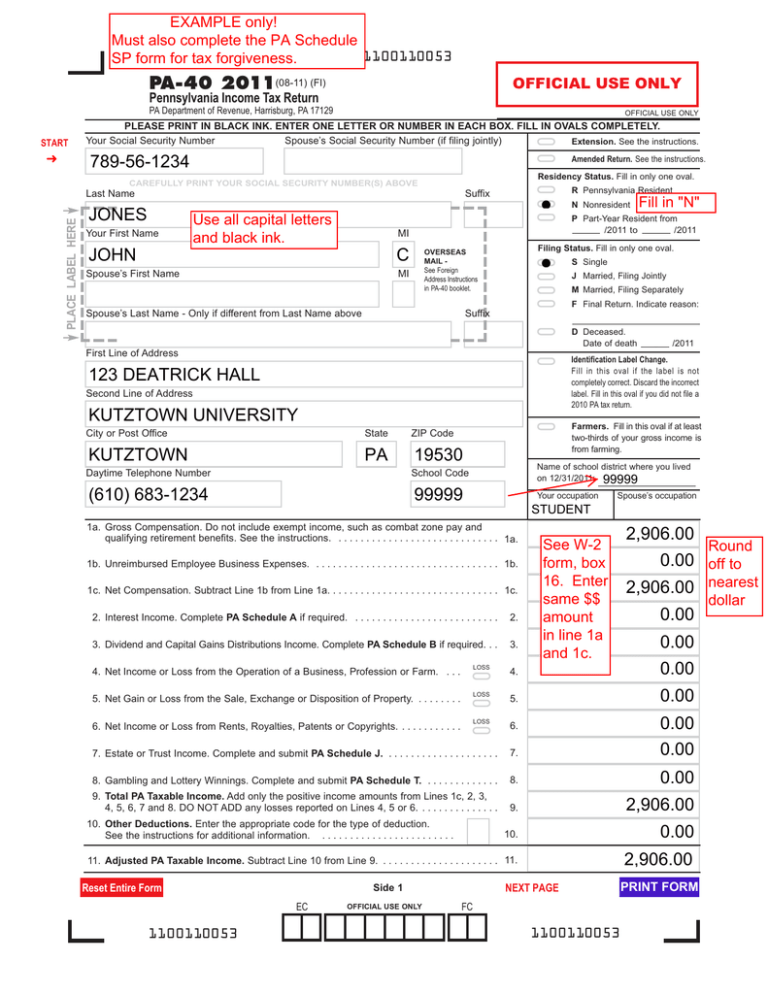

You can receive a Pennsylvania Tax Forgiveness Credit for up to 100 of your income tax on PA-40 Line 12. Turbo says we qualify for PA tax forgiveness but this made no difference in our tax due Topics. Taxpayers who qualify for PAs Tax Forgiveness program may also qualify for the federal Earned Income Tax Credit program.

Ad Apply For Tax Forgiveness and get help through the process. Use PA-40 Schedule SP to claim the Tax Forgiveness Credit for taxpayers who meet the qualifications to reduce all or a part of their Pennsylvania Tax Liability. Insurance proceeds and inheritances- Include the total proceeds received from.

TurboTax indicates that we are eligible for the PA Special Tax Forgiveness Credit for 2021. At the bottom of that column is the percentage of Tax Forgiveness for which you qualify. However we also received 40k in Social.

Form PA-40 SP requires. If your Eligibility Income. Free cosultation tax investigation tax resolution continued tax education.

Ad 4 Simple Steps to Settle Your Debt. Ad I need Traxion on my tax issues. Ad Owe IRS 10K-250K Back Taxes Estimate Tax Debt Online to Check Eligibility.

Provides a reduction in tax. Complimentary Tax Analysis With No Obligation. Resolve IRS State Tax Problems.

Tax forgiveness gives a state tax refund to some taxpayers and forgives some taxpayers of their liabilities even if they havent paid their Pennsylvania income tax. The Tax Forgiveness Program allows low income taxpayers to either reduce or eliminate their tax liability through tax forgiveness credits. In Part D calculate the amount of your Tax Forgiveness.

We provide Immediate IRS Help to Stop Wage Garnishment and End Your Tax Problems. Ad Use our tax forgiveness calculator to estimate potential relief available. What is Pennsylvania REV 419 ex.

Harrisburg PA With the personal income tax filing deadline approaching on May 17 2021 the Department of Revenue is reminding low-income. S Web site at wwwirsgov or call the IRS toll-free 1-800-829. Tax forgiveness gives a state tax refund to some taxpayers and forgives some taxpayers of their liabilities even if they havent paid their Pennsylvania income tax.

Connect me now to get my Free Traxion Tax Consultation. You andor your spouse are liable for Pennsylvania tax on your income. Taxpayers may only claim dependents who are minor or adult children claimed as dependents on their federal income tax returns.

The qualifications for the Tax Forgiveness Credit are as follows. You May Qualify to be Forgiven for Tens of Thousands of Dollars in Taxes. Record the your PA tax liability from Line 12 of your PA-40.

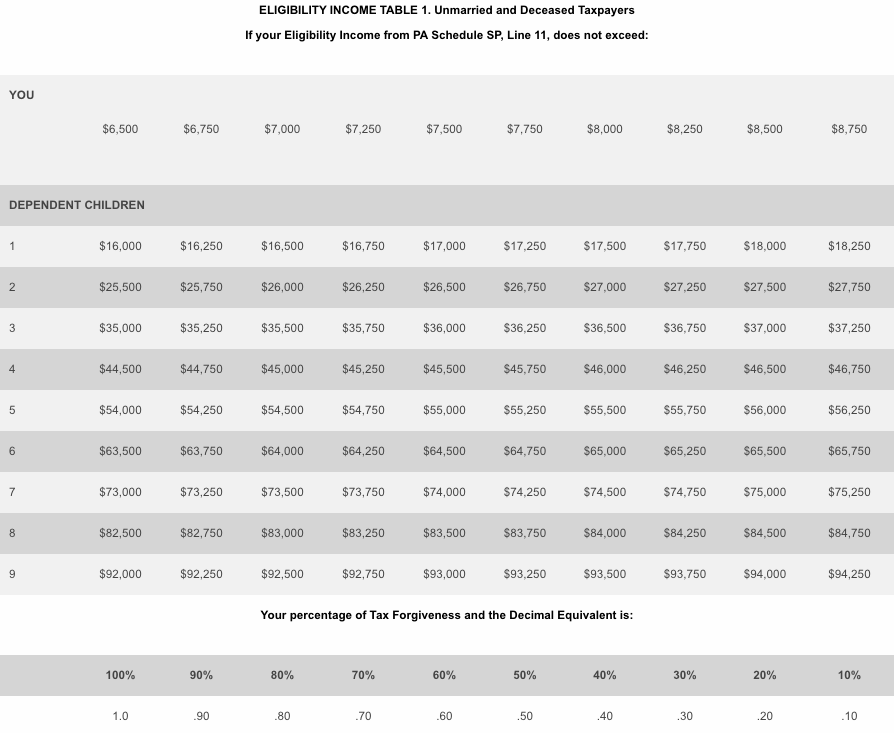

Record tax paid to other states or countries. For more information please see. Then move across the line to find your eligibility income.

0 1 1109 Reply. For PA purposes qualifying. Helping Taxpayers Since 2007.

Qualifications for this credit will depend on your eligibility income state withholdings and family size. You are subject to Pennsylvania personal income tax. At the bottom of each column is an amount expressed as a decimal which represents the percentage of tax.

The IRS debt forgiveness. The Mixed-Use Development Tax Credit program administered by the Pennsylvania Housing Finance Agency authorizes the Agency to sell 45 million of state tax credits to qualified. You can potentially receive a.

Tax forgiveness is a credit that allows eligible taxpayers to reduce all or part of their Pennsylvania personal income tax. The PA earned income was 9100. Ad Dont Waste Money and Time Fighting the IRS Alone - Choose the Best Tax Relief Services.

ELIGIBILITY INCOME TABLE 1. What do I include in the. To claim this credit it is necessary that a taxpayer file a PA-40.

Tax Relief Help 2022 Top Brands Comparison Online Offer. What is tax forgiveness program. You can receive a Pennsylvania Tax Forgiveness Credit for up to 100 of your income tax on PA- 40 Line 12.

Unmarried and Deceased Taxpayers.

Form Pa 40 Schedule Sp Download Fillable Pdf Or Fill Online Special Tax Forgiveness 2020 Pennsylvania Templateroller

Late 1700 S Early 1800 S Shot Pouch With Horn Amp Accoutrements Pouch Life Pictures Horns

Testamentary Capacity Youtube Youtube Capacity

Pa Dor Pa 40 Sp 2019 2022 Fill Out Tax Template Online Us Legal Forms

Form Pa 40 Schedule Sp Download Fillable Pdf Or Fill Online Special Tax Forgiveness 2020 Pennsylvania Templateroller

Pennsylvania Special Tax Forgiveness Credit Do You Qualify Supermoney

Low Income Pennsylvanians May Be Missing Out On Pa Tax Refunds Of 100 Or More

13589 Pa Municipality Tax Return Out Of State Credit For School Tax

Form Pa 40 Schedule Sp Download Fillable Pdf Or Fill Online Special Tax Forgiveness 2020 Pennsylvania Templateroller

What Does The Cares Act Mean For Pslf Borrowers Future Proof M D The Borrowers Public Service Loan Forgiveness Federal Student Loans

Credit Card Debt Forgiveness A Realist S Guide Debt Com

Form Pa 40 Schedule Sp Download Fillable Pdf Or Fill Online Special Tax Forgiveness 2020 Pennsylvania Templateroller

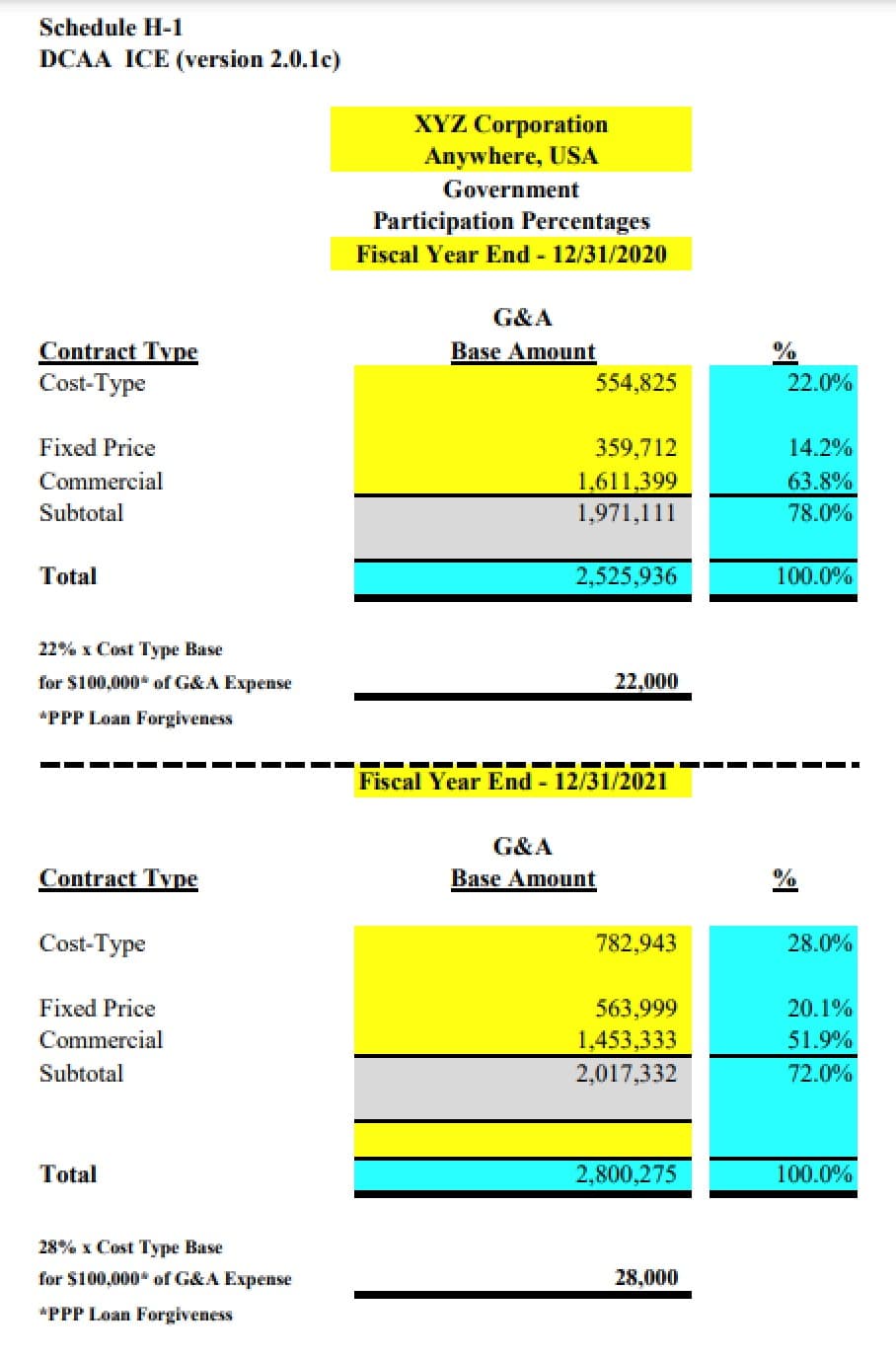

Ppp Loan Forgiveness And Far Credits For Government Contractors Grf Cpas Advisors

Someone Untied Betsy Devos S Yacht In Ohio Damage Ensued Student Loans Student Loan Debt Home Ownership

500 Million Flaming Salute Join Zippo June 5th On Facebook For Up To Date Infor Credit Card Debt Forgiveness Private Mortgage Lenders Debt Consolidation Loans